What's new?

Investments

Now you can check your HSBC Securities (USA) Inc.1 investments anytime, anywhere. View your portfolio and holdings information, now available conveniently in the Mobile Banking App.

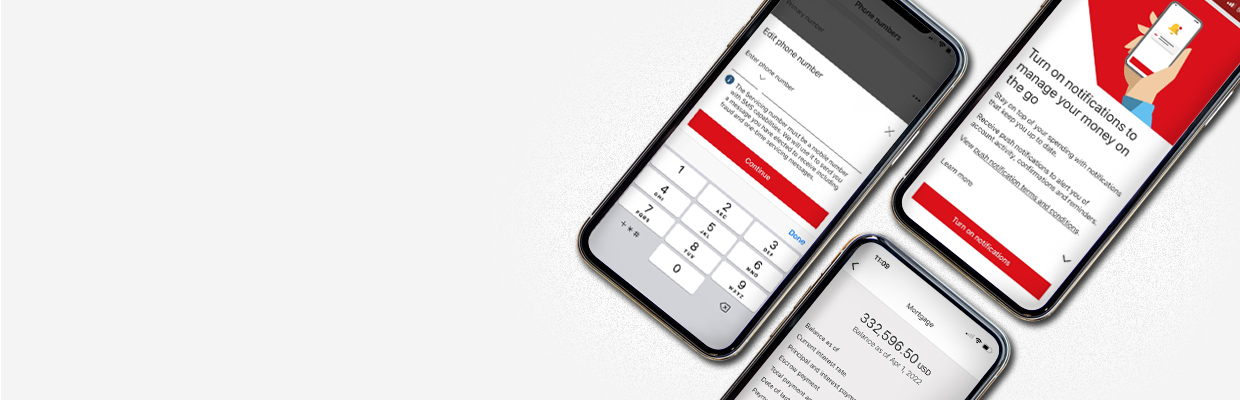

Update your personal details

Check and update your personal details so that we know how to contact you. Now available conveniently in the HSBC Mobile Banking app2.

Access your Mortgage or HELOC Details

Now you can view your Mortgage or HELOC account details including payment information, current due date, interest rate, and more.

One touch and you're in

With the HSBC Mobile Banking App, you can manage your everyday banking needs anytime, anywhere. Discover a wide range of features and services on the app, and experience an ease of use like never before. Simply scan the QR Code® to get the latest updates.

Using the camera on your smartphone or tablet to scan the QR Code will take you directly to our mobile app page on the Apple App Store or Google Play.

Already registered for Online Banking?

Use the same log on credentials (Username and Password) for HSBC Mobile Banking that you use for Personal Internet Banking.

New to Online Banking?

Register from your mobile device. Select 'Log On' and then 'Not Registered?‘.

To register for Online Banking, you'll need either:

- Social Security Number, an HSBC account number, and a one-time code (sent to your email or mobile number)

- Social Security Number, HSBC Card and PIN

- Electronic Banking Number (EBN) and a 6 Digit Code (sent to you by a HSBC representative)

Check out some other things you can do

- Login quickly and securelyLog into the Mobile Banking App2 quickly and securely with Fingerprint ID for AndroidTM and, Touch ID® and Face ID® for Apple®.

- Transfer funds in real-timeWith our Real-Time Payments (RTP®) System you can transfer funds4 in real time using your HSBC checking or savings account.

- Mobile Check DepositTake a photo of your check and deposit it directly into your eligible HSBC checking or savings account via iPhone®, iPad®, or AndroidTM devices.

- Bill PaymentsPay bills to virtually anyone in the U.S. from your eligible U.S. HSBC accounts.

- Global Transfers5HSBC Premier and existing HSBC Advance customers, move funds from eligible U.S. deposit accounts to your eligible HSBC deposit accounts in other countries on supported mobile devices.

- Secure MessagingIn-app messaging to our Customer Relationship Center.

- Heloc transfersTransfer available funds from your HELOC directly into your HSBC checking account.

Manage your credit card in the HSBC Mobile App

Card Activation

To activate your credit card from the mobile app:

- Select your credit card from the ‘Accounts’ menu

- Choose ‘Activate card’ and follow the on-screen instructions

Pending Transactions

View your pending transactions in real-time in the HSBC Mobile Banking App. Your purchases can be seen as soon as they’ve been made. All pending credit card transactions will show in the Activity section and will be noted with a pending icon under the amount.

e-Statements

View up to 7 years of electronic statements on the app at any time.

Mobile Pay

Add your card to your mobile wallet to shop with your mobile phone or online.9

Terms and Conditions

| ARE NOT A DEPOSIT OR OTHER OBLIGATION OF THE BANK OR ANY OF ITS AFFILIATES |

ARE NOT FDIC INSURED |

ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY |

ARE NOT GUARANTEED BY THE BANK OR ANY OF ITS AFFILIATES |

MAY LOSE VALUE |

All decisions regarding the tax implications of your investment(s) should be made in consultation with your independent tax advisor.

United States persons are subject to U.S. taxation on their worldwide income and may be subject to tax and other filing obligations with respect to their U.S. and non-U.S. accounts. U.S. persons should consult a tax advisor for more information.

Research backgrounds of brokers and firms for free by visiting FINRA's BrokerCheck website.

2 Data rate charges from your service provider may apply. HSBC Bank USA, N.A. is not responsible for these charges. Camera-in device required to be able to utilize HSBC Mobile Check Deposit. Deposit amount limits may apply. HSBC Mobile Banking App is available for iPhone®, iPad®, AndroidTM devices and must be downloaded from the App StoreTM or Google PlayTM.

3 HSBC Global Money account is a prepaid, multi-currency account available on our Mobile Banking App for customers who maintain an HSBC consumer deposit account.

4 Transfer limits apply, see Rules for Consumer Deposit Accounts for more information.

5 Global View and Global Transfers are only available for HSBC Premier and existing HSBC Advance clients and are not available in all countries. Foreign currency exchange rates and local country limitations may apply. Transfers from HSBC accounts from outside the U.S. may be subject to transfer fees. Personal Internet Banking is required to access Global View and Global Transfers. Access to U.S. Personal Internet Banking through Global View from outside the U.S. may be limited.

6 To qualify for an HSBC Premier relationship, you need to open an HSBC Premier checking account and meet one of the following requirements. A monthly maintenance fee10 of $50 will be incurred if at least one of these requirements is not maintained. Refer to your ‘HSBC Premier Terms and Charges Disclosure' for full details.

- Balances of $100,000 in combined U.S. consumer and qualifying commercial U.S. Dollar deposit and investment11 accounts; OR

- Monthly recurring direct deposits12 totaling at least $5,000 from a third party to an HSBC Premier checking account(s); OR

- Any HSBC U.S. residential mortgage loan serviced by HSBC. Home Equity products, loans that are in foreclosure or bankruptcy, and loans for which servicing rights have been transferred are not included

- Consumers who maintain Private Bank status13

A monthly maintenance fee of $50 will be incurred if one of these requirements is not maintained.

7 The HSBC Advance Checking account is no longer offered.

8 Accounts eligible for Global Transfers include all HSBC deposit accounts, except for CDs. Federal Reserve Reg D Transaction Limitations apply. All HSBC accounts, however, are viewable within Global View.

9 Apple Pay works with iPhone 6 and later in stores, apps, and websites in Safari; with Apple Watch in stores and apps; with iPad Pro, iPad Air 2, and iPad mini 3 and later in apps and websites; and with Mac in Safari with an Apple Pay enabled iPhone 6 or later or Apple Watch. For a list of compatible Apple Pay devices, see https://support.apple.com/km207105.

10 You will not be charged a Monthly Maintenance Fee for the calendar month in which you open your account and the following 3 calendar months (together, the “Waiver Period”), whether you meet the qualifying criteria or not. If immediately after the “Waiver Period”, you have not met one of the HSBC Premier qualification criteria and your HSBC Premier checking account is charged 3 consecutive Monthly Maintenance Fees, your account will be closed. In addition, any other checking, savings, credit card and Global Money Accounts that you own will be closed, unless you (or a joint account holder on those accounts) hold a different HSBC Premier checking account.

11 Investment and annuity products are offered by HSBC Securities (USA) Inc. (HSI), member NYSE/FINRA/SIPC. HSI is an affiliate of HSBC Bank USA, N.A.

12 Qualifying direct deposits are electronic deposits of regular periodic payments (such as salary, pension, Social Security, or other regular monthly income) deposited through the Automated Clearing House (ACH) network to this account by your employer or an outside agency (please check with your employer or outside agency to determine if they use the ACH network). Direct deposits that do not qualify include but are not limited to transfers from one account to another, mobile deposits, or deposits made at a Wealth Center or ATM.

13 To become an HSBC Private Bank customer, you must be invited and reviewed on an individual basis. See your Relationship Manager for details.

Apple, the Apple logo, Apple Pay, Apple Watch, iPad, iPhone, Mac, Safari, and Touch ID are trademarks of Apple, Inc., registered in the U.S. and other countries. iPad Pro is a trademark of Apple Inc.

Garmin and Garmin logo are trademarks of Garmin, Ltd. or its subsidiaries and are registered in one or more countries, including the U.S. Garmin Pay is a trademark of Garmin Ltd. or its subsidiaries.

Google Pay is a trademark of Google LLC.

Samsung, Samsung Pay, Galaxy S7 and Samsung Knox are trademarks or registered trademarks of Samsung Electronics Co., Ltd. Other company and product names mentioned may be trademarks of their respective owners. Screen images are simulated; actual appearance may vary. Samsung Pay is available on select Samsung devices.

All consumer HSBC Mastercard® Credit and Debit cards, issued by HSBC Bank USA, N.A. are compatible with Apple Pay, Google Pay, Samsung Pay, and Garmin Pay.

United States persons are subject to U.S. taxation on their worldwide income and may be subject to tax and other filing obligations with respect to their U.S. and non-U.S. accounts. U.S. persons should consult a tax adviser for more information.

iOS is a trademark or registered trademark of Cisco in the U.S. and other countries

Apple, iPhone, iPad, Touch ID and Face ID are trademarks of Apple Inc., registered in the U.S. and other countries.

Android and Google Play are trademarks of Google LLC.

App Store is a registered trademark of Apple Inc.

QR Code is a registered trademark of Denso Wave Incorporated.

RTP® is a registered service mark of The Clearing House Payments Company LLC

HSBC credit cards are issued by HSBC Bank USA, N.A., subject to credit approval and requires a U.S. HSBC checking account relationship. To learn more, speak with an HSBC representative.